Why did the colonists hate taxes so much?

The evidence becomes overwhelming that Americans opposed seemingly light taxes, not because they were paranoid, but because the taxes were charged in silver bullion, a money few colonists used on a regular basis and most never had. Thomas Paine had outlined the logic of resistance in June 1780. “There are two distinct things which make the payment of taxes difficult; the one is the large and real value of the sum to be paid, and the other is the scarcity of the thing in which the payment is to be made.”…Adam Gordon, an MR for Aberdeenshire who was traveling in Virginia in 1765, wrote that he was “at a loss to find how they,” some of the wealthiest colonists in the New World, Virginia’s slave-driving tobacco planters, “will find Specie, to pay the Duties last imnosed on them by the Parliament.”

That is from the new and excellent Money and the Making of the American Revolution, by Andrew David Edwards.

The evolution of Albanian AI governance

Albania’s AI-generated minister, Diella, is “pregnant,” Prime Minister Edi Rama has announced. He revealed plans to create “83 children”, or assistants, one for each Socialist Party member of parliament.

“We took quite a risk today with Diella here and we did very well. So for the first time Diella is pregnant and with 83 children,” he said at the Global Dialogue (BGD) in Berlin. Rama said the “children,” or assistants, will record everything that happens in parliament and keep legislators informed about discussions or events they miss.

“Each one…will serve as an assistant for them who will participate in parliamentary sessions, and will keep a record of everything that happens and will suggest members of parliament. These children will have the knowledge of their mother,” Rama said.

Here is the full story, bizarre throughout. At least you cannot say they are anti-natalist.

What should I ask Dan Wang?

Yes, I will be doing a podcast with him. Dan first became famous on the internet with his excellent Christmas letters. More recently, Dan is the author of the NYT bestselling book Breakneck: China’s Quest to Engineer the Future.

Here is Dan Wang on Wikipedia, here is Dan on Twitter. I have known him for some while. So what should I ask him?

Sunday assorted links

1. Context is that which is scarce Africa and mining.

2. Refine, a new tool for research papers.

3. Conservative renaissance at Stanford?

4. Growing up with economic growth makes you trust government more.

5. Those old and new service sector jobs.

6. What is psychological solipsism correlated with?

7. Early Justin Wolfers piece on point shaving in NCAA basketball.

*The Loneliness of Sonia and Sunny*, now finished

This novel took me a long time to read, mostly because it was so good (and pretty long at about 660 pp.). It keeps on getting better and more closely knit together, requiring additional levels of attention. Apart from being an entrancing story and beautifully written, it is the best fiction I know on:

The near-metaphysical difficulties of immigrant assimilation

The strength and pull of Indian culture

The difficulties of escaping one’s own romantic past, most of all for women

The growing attitude gap between men and women in matters of romance

What Indians bring to America from “the old country,” whether they wish to or not

Loneliness in cosmopolitan modern life, and why it is so difficult to escape

The novel has multiple layers, and by the time you finish you realize the earlier story has a somewhat different meaning than you were thinking all along. Desai pulls this off very well. So this one is still recommended. Here is a very good Adam Mars-Jones LRB review, really a masterful piece, noting it is full of spoilers.

Are new data centers boosting electricity prices?

But a new study from researchers at Lawrence Berkeley National Laboratory and the consulting group Brattle suggests that, counterintuitively, more electricity demand can actually lower prices. Between 2019 and 2024, the researchers calculated, states with spikes in electricity demand saw lower prices overall. Instead, they found that the biggest factors behind rising rates were the cost of poles, wires and other electrical equipment — as well as the cost of safeguarding that infrastructure against future disasters.

“It’s contrary to what we’re seeing in the headlines today,” said Ryan Hledik, principal at Brattle and a member of the research team. “This is a much more nuanced issue than just, ‘We have a new data center, so rates will go up.’”

North Dakota, for example, which experienced an almost 40 percent increase in electricity demand thanks in part to an explosion of data centers, saw inflation-adjusted prices fall by around 3 cents per kilowatt-hour. Virginia, one of the country’s data center hubs, had a 14 percent increase in demand and a price drop of 1 cent per kilowatt-hour. California, on the other hand, which lost a few percentage points in demand, saw prices rise by more than 6 cents per kilowatt-hour.

Here is the full story, via Cliff Winston.

What should I ask Andrew Ross Sorkin?

Yes, I will be doing a Conversation with him. From Wikipedia:

Andrew Ross Sorkin (born February 19, 1977) is an American journalist and author. He is a financial columnist for The New York Times and a co-anchor of CNBC’s Squawk Box. He is also the founder and editor of DealBook, a financial news service published by The New York Times. He wrote the bestselling book Too Big to Fail and co-produced a movie adaptation of the book for HBO Films. He is also a co-creator of the Showtime series Billions.

In October 2025, Sorkin published 1929: Inside the Greatest Crash in Wall Street History–and How It Shattered a Nation, a new history of the Crash based on hundreds of documents, many unpublished.

Most of all I am interested in his new book, but not only. So what should I ask him?

Saturday assorted links

Are the ACA exchanges unraveling?

After all, that is what economists predicted if the mandate was not tightly enforced. Here is the latest reprt:

Premiums for the most popular types of plans sold on the federal health insurance marketplace Healthcare.gov will spike on average by 30 percent next year, according to final rates approved by the Centers for Medicare and Medicaid Services and shown in documents reviewed by The Washington Post.

The higher prices — affecting up to 17 million Americans who buy coverage on the federal marketplace — reflect the largest annual premium increases by far in recent years.

Here is the full article.

Should we worry about AI’s circular deals?

The yet once again on target Noah Smith reports:

As far as I can tell, there are two main fears about this sort of deal. The first is that the deals will artificially inflate companies’ revenue, tricking investors into overvaluing their stock or lending them too much money. The second is that the deals increase systemic risk by tying all of the AI companies’ fortunes to each other.

Let’s start with the first of these risks. The question here is whether AI’s circular deals are an example of round-tripping or vendor financing.

Suppose two startups — let’s call them Aegnor and Beleg2 — secretly agree to inflate each other’s revenue. Aegnor buys ad space on Beleg’s website, and Beleg buys ad space on Aegnor’s website. Both companies’ revenues go up. They’re not making any profits, and they’re not generating any cash flows, because the money is just changing hands back and forth. But if investors are looking for companies with “traction”, they might see Aegnor and Beleg’s topline revenue numbers go up. If they fail to dig any deeper, they might give both companies a bunch of investment money that they didn’t earn. This is called “round-tripping”, and it happened occasionally during the dotcom boom.

Now what I just described is completely illegal, because the companies colluded in secret. But you can also have something a little similar happen by accident, in a perfectly legal way. If there are a bunch of startups whose business model is selling to other startups, you can get some of the “round-tripping” effect without any collusion.

On the other hand, it’s perfectly normal and healthy for, say, General Motors to lend its customers the money they use to buy GM cars. In fact, GM has a financing arm specifically to do this. This is called vendor finance. It’s perfectly legal and commonplace, and most people think there’s nothing wrong with it. The transaction being financed — a customer buying a car — is something we know has value. People really do want cars; GM Financial helps them get those cars.

So the question is: Are the AI industry’s circular deals more like round-tripping, or are they more like vendor finance? I’m inclined to say it’s the latter.

Noah stresses that the specifics of these deals are widely reported, and no serious investors are being fooled. I would note a parallel with horizontal or vertical integration, which also can have a financing element. Except that here corporate control is not being exchanged as part of the deal. “I give him some of my company, he gives me some of his — my goodness that is circular must be some kind of problem there!”…just does not make any sense.

Emergent Ventures India, 11th cohort

Saket Sinha is an accomplished bansuri virtuoso with more than seventy students worldwide. His grant enables a move to Mumbai.

Riddhi Jain, 17, received her grant to build an AI-powered mental health system addressing unaffordable and stigmatized therapy.

Advik Kapoor, 16, received his grant for Exerton, to help builders get started with their dream projects.

Vibhuti Bafna, Aliya Mamadfozilova, Julian Drotkiewicz and Enya Dumitru are high-schoolers in four different countries. They received their grant for Waste2o, turning agricultural waste into potable water.

Ishan Khire, 18, received his grant for Rural Analytics, to make rural development data more accessible for researchers.

Nikitaa Sivaakumar received her grant to develop interactive visual aids for high school science teachers.

Jhillika Trisal (with Falguni Shrivastava and Souvik Ghosh) received her grant for building Cognitii, an AI‑plus‑human learning platform for children with special needs; the grant scales pilots and the personalization engine.

Piyush Jha, 18, founder of Vasudeva Innovations, received his grant to turn wastewater into clean energy while earning carbon credits.

Ambreen Deol is an aspiring surgeon who has rotated at Cleveland Clinic, Stanford, Mount Sinai and UAB, received her grant for travel and general career support.

Anjali Jayaraman, 14, received her grant for Repay Smart, to help young adults make smarter financial decisions using gamification.

Arjun Khemani received his grant for the Arjun Khemani Podcast, and work on his writing. His latest book Lords of the Cosmos (With Logal Chipkin) is out now.

Adwait Dandwate received his grant for Vardhishnu, to create learning spaces for children from vulnerable backgrounds.

Amruth Ravindranath is a neuroscience researcher, and received his grant to develop cognitive assessments and AI models that personalize mental health chatbots to each person’s unique cognitive fingerprint.

Shaunak Agarkhedkar is a novelist, and received his grant to write novels challenging myths about stray animals.

Kaustubh Bankapure received his grant to create an online learning model of applied theatre education for Indian educators.

Kavish Garg, 18, a sophomore studying math and philosophy at Stanford, received his grant for conference and travel support.

Ria Khurana and Tanmaya Gulati, both 22 and studying medicine, and founders of RNT Health Insights, received their grant to develop medical devices detecting early-stage gastrointestinal cancers.

Those unfamiliar with Emergent Ventures can learn more here and here. The EV India announcement is here. More about the winners of EV India second cohort, third cohort, fourth cohort, fifth cohort, sixth cohort, seventh cohort, eighth cohort, ninth cohort, and tenth cohort. To apply for EV India, use the EV application, click the “Apply Now” button and select India from the “My Project Will Affect” drop-down menu.

And here is Nabeel’s AI engine for other EV winners. Here are the other EV cohorts.

If you are interested in supporting the India tranche of Emergent Ventures, please write to me or to Shruti at [email protected].

TC again: I thank Shruti for writing this post for me.

Who Pays for Tariffs Along the Supply Chain?

This paper examines the effects of tariffs along the supply chain using product-level data from a large U.S. wine importer in the context of the 2019-2021 U.S. tariffs on European wines. By combining confidential transaction prices with foreign suppliers and U.S. distributors as well as retail prices, we trace price impacts along the supply chain, from foreign producers to U.S. consumers. Although pass-through at the border was incomplete, our estimates indicate that U.S. consumers paid more than the government received in tariff revenue, because domestic markups amplified downstream price effects. The dollar margins per bottle for the importer contracted, but expanded for distributors/retailers. Price effects emerge gradually along the chain, taking roughly one year to materialize at the retail level. Additionally, we find evidence of tariff engineering by the wine industry to avoid duties, leading to composition-driven biases in unit values in standard trade statistics.

That is from a new NBER working paper by

Friday assorted links

1. Should AI surrogates of you make your life and death decisions?

2. “According to Federal Railroad Administration data, the Brightline has been involved in at least 185 fatalities, 148 of which were believed not to be suicides, since it began operating, in December 2017. Last year, the train hit and killed 41 people—none of whom, as best as authorities could determine, was attempting to harm themselves.” Link here.

3. The Recoding America Fund, from Jennifer Pahlka.

4. Dean Ball on the call for a superintelligence ban, Dean is right once again. Mainly (once again) a lot of irresponsibilitiy on the other side of that ledger, you will not see them seriously address the points that Dean raises. If you want to go this route, do the hard work and write an 80-page paper on how the political economy of such a ban would work.

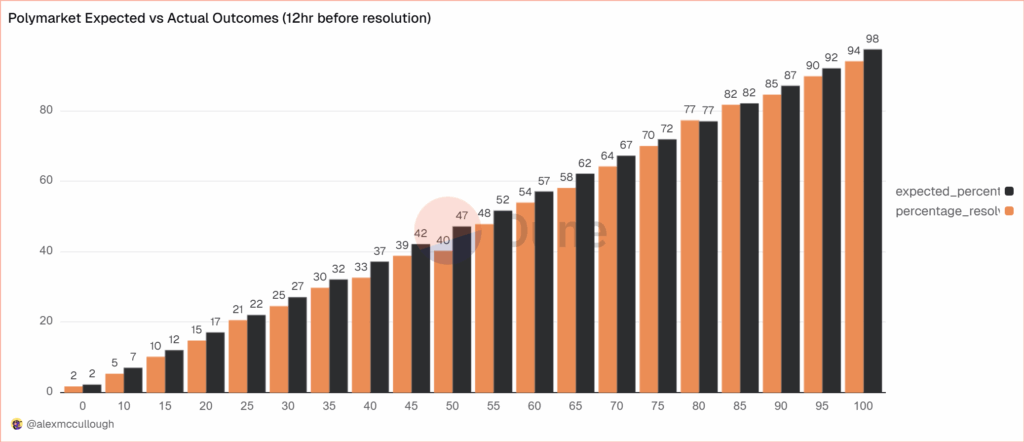

Prediction Markets Are Very Accurate

alexmccullough at Dune has a very good post on the accuracy of Polymarket prediction markets. First, how do we measure accuracy? Suppose a prediction market predicts an event will happen with p=.7, i.e. a 70% probability. The event happens. How do we score this prediction? A common method is the Brier Score which is the mean squared difference from the actual outcome. In this case the Brier Score is (0.70−1)2 = 0.09. Notice that if the prediction market had predicted the event would have happened with 90% probability, a better prediction, then the Brier Score would have been (0.90−1)2 = 0.01 a lower number. If the event had not happened then the Brier Score for a 70% prediction would have been (0.70−0)2 = 0.49, a higher number. Thus, a lower Brier Score is better.

Across some 90,000 predictions the Polymarket Brier Score for a 12 hour ahead prediction is .0581. As Alex notes:

A brier score below 0.125 is good, and below 0.1 is great. Polymarket’s total score is excellent, and puts it on par with the best prediction model’s in existence… Sports betting lines tend to average a brier score of between .18-.22.

Brier Scores have been widely used to measure weather forecasts. A state of the art 12 hour ahead forecast of rain, for example, might have a Brier Score of .0.05 – 0.12 so if Polymarket suggest a metaphorical umbrella you would be wise to listen.

Moreover, highly liquid markets are even more accurate.

Even markets with low liquidity have good brier scores below 0.1, but markets with more than $1m in total trading volume have scores of 0.0256 12 hours prior to resolution and 0.0159 a day prior. It’s hard to overstate how impressive that is.

There are, however, some small but systematic errors. The following bar chart splits events into 20 buckets of 5% each so the first bucket covers events that were predicted to happen 0-5% of the time and the last bucket covers events that were predicted to happen 95-100% of the time. The black bar gives the predicted probability, the orange bar the actual frequencies. As expected, events which are predicted to happen more often do happen more often with a very nice progression. Note, however, that the predicted probability is almost always slightly higher than the actual frequency. This means that people are paying a bit too much. It’s unclear whether this is due to market design issues such as the greater difficult of shorting or something about the Automated Market Makers or due to psychological factors such as favorite bias. Thus, some room for improvement but very impressive overall.

Some further new negative results on minimum wage hikes

We study how exposure to scientific research in university laboratories influences students’ pursuit of careers in science. Using administrative data from thousands of research labs linked to student career outcomes and a difference-in-differences design, we show that state minimum wage increases reduce employment of undergraduate research assistants in labs by 7.4%. Undergraduates exposed to these minimum wage increases graduate with 18.1% fewer quarters of lab experience. Using minimum wage changes as an instrumental variable, we estimate that one fewer quarter working in a lab, particularly early in college, reduces the probability of working in the life sciences industry by 2 percentage points and of pursuing doctoral education by 7 percentage points. These effects are attenuated for students supported by the Federal Work-Study program. Our findings highlight how labor market policies can shape the career paths of future scientists and the importance of budget flexibility for principal investigators providing undergraduates with research experience.

That is from a new working paper by Ina Ganguli and Raviv Murciano-Goroff.